A & E Billing Solutions for Insurance Companies

A&E Billing is not your ordinary billing company. We dedicate ourselves to providing a high-quality service that will help your business to achieve its maximum potential. With modern, up-to-date technology to protect your private information and experienced billing and payment processors to assist your business with this important function, A&E Billing strives to be your number one billing solution.

Whether you are a home insurance company or are involved in motor or business policies, we are here to help!

Our full-service company is here to help you with all of your invoicing, payment processing and account management needs. When you have an experienced billing and payment processing company on your side, you have more time to dedicate to what’s really important: running your business.

Obtaining Low Mortgage Protection Insurance

Mortgage payment protection insurance (MPP) will cover your premium each month if you become sick or lose your job and are unable to pay the mortgage. Many MPP policies will pay out the premiums for a maximum of one year. There are many benefits of buying a mortgage protection policy from a reliable insurance provider in Ireland. Here is why you need to obtain low mortgage protection policy from a leading provider.

If you become sick or lose the job, mortgage protection insurance will cover your insurance premium each month. Some companies pay the premium for six months, one year or even two years until you recover from the illness or find a new job. When you choose a policy that pays 125% of the mortgage premium every month, you can pay some of the other bills, too. Most MPP policies will cover you for the following reasons.

- Accidents

- Sickness

- Unemployment

The type of policy you choose will depend on your situation and budget. Mortgage bills are one of the largest bills faced by the average homeowner. It takes around 18% of your household income every month – if you live in Ireland. This goes up to 24% if you live in London. That’s why it is important that you think about how you are going to pay the mortgage if you or your partner lose the job or become ill. The situation becomes even worse if you are self-employed. You won’t be eligible for sick and redundancy pay if you are self-employed. That’s where mortgage protection insurance comes in handy. Make sure you obtain a policy from a reputable insurance provider.

Low leads the way when it comes to low-cost MPP insurance in Ireland. They pledge to beat any comparable price in the country. It is one of the most cost-effective MPP policies on the market today. The company employs some of the best insurance specialists in the industry. You can get your mortgage protection quote in a few minutes by filling the online form of the company. An insurance specialist from the company will be in touch with you to advise you on the best MPP policy to suit all your needs and budget.

The cost of mortgage protection insurance may depend on many factors. Your age, health condition, the mortgage repayment, and the type of policy you choose are some of these factors. You can choose the right policy based on your salary and the mortgage amount. You should do the homework before choosing the best policy on the market. The internet is a good place to start your research. Make sure you do extensive research before buying mortgage payment protection insurance.

If you are looking for low-cost mortgage payment protection insurance in Ireland, you have come to the right place. With so many insurance providers in the country, choosing the right one isn’t easy. Low Insurance is one of the best providers for cheap MPP policies.

Choosing Home And House Insurance

If you have recently bought a house or moved into a new home, you need to consider the insurance that you need. The problem is that there are many insurance providers and policies that you can choose from. This is why you need to know what to look for in the home and house insurance that you get.

Buildings Insurance

If you have purchased a house, you will need to get buildings insurance. This insurance will give you the protection you need should something happen to your home such as a fire. When you look at this insurance, you need to estimate the cost to rebuild your home.

This can be hard to do and many people overestimate this. The rebuild cost will be for the physical house only and should not include the land. It will also exclude all of the items in your home.

Home Contents Insurance

If you have bought a house or are renting, you need to get contents insurance. This insurance will protect all of your possessions. When it comes to purchasing this insurance, you need to value all of the items in your home.

The best way to go about doing this will be on a room by room basis. This will ensure that you do not miss anything that will not be covered when you get the insurance. It is also important that you not undervalue any of the items as you will end up having to pay out of pocket should you need to make a claim.

Check The Damage That Is Covered

Knowing the types of insurance that you need to get is important, but you need to know what is covered. Many insurance policies will only cover certain events that cause damage to the building or your possessions. It is very important that you read through the policy and find out what the exceptions are.

Accidental damage is one area that you need to focus on. Most policies will provide accidental damage coverage, but your contents insurance might exclude damage caused while cleaning, maintaining or repairing items. Your contents will also generally not be covered if they are damaged outside of your home.

The Excess

If you want lower monthly premiums, you can increase the excess on your policy. This can lower the monthly burden, but you need to be very careful with this as you will have to pay the excess before you can make a claim. Ideally, you will want the excess to be as low as possible to save you paying large amounts before you can claim.

Some insurance policies will have different excess amounts for different sections of your policy. You need to check the whole policy to ensure that the one excess is being used throughout. The excess will need to be an amount that you can comfortably afford in times of trouble.

Investing in Home and house insurance is something that you need to badly need. Buildings insurance is only required if you own the property, but you need to have contents insurance even if you rent. You also need to know what damage is covered and what the excess of the policy is.

The Best Insurance Brokers In Ireland

Choosing the best insurance brokers in Ireland isn’t easy when you are shopping for house, life or vehicle insurance. Each broker specialises in one or two aspects of insurance, and you need to pick the right broker depending on what type of insurance you want. That’s where your extensive research comes in handy. Your research will let you pick the right insurance broker in Ireland. Here are some factors to consider when choosing the best insurance brokers in Ireland.

There is a vast difference between an insurance agent and a broker. An insurance agent works for a particular insurance company and his or her loyalty is with that company. You will get quotes only from a particular company because the agent will promote the products of his or her company. Your choices are limited when you approach an insurance agent to buy insurance products. But a broker has access to different insurance products from different insurance companies on the market. You can compare the products and opt for the best product that suits your needs and budget. That’s why you need to opt for an insurance broker in Ireland when buying life, vehicle, or home insurance.

With a wide variety of insurance products to choose from, you can easily choose the right policy to suit your needs and budget. A broker will provide with unbiased and informed advice when choosing a life, home or car insurance. Comparison shopping is essential when choosing a life, vehicle or home insurance to suit your budget and needs. A broker facilitates this aspect when buying insurance to suit your needs. That’s why you need to rely on an insurance broker when shopping for insurance products in Ireland.

An insurance broker will look to create a long-term relationship with their clients. In fact, the broker will spend more time to get to know their clients because they value the long-term relationship with their clients. In comparison, an insurance agent won’t take the time to build a long-term relationship with their clients. The client will usually deal with a different agent each time they contact the company. As a result, no relationship is maintained over time. That’s why you need to opt for an insurance broker when buying life, car or home insurance in Ireland.

Ireland has its own share of insurance brokers. With so any insurance brokers on the market, choosing the best insurance broker isn’t easy. You should be doing extensive research before choosing the best insurance brokers in Ireland. The internet is the best place to start your search in this regard. Make sure you check the reputation, experience, financial stability, and customer feedback of the potential insurance broker before choosing the best broker in Ireland.

Are you searching for the best insurance brokers in Ireland? If so, you have come to the right place. There are many insurance brokers operating in Ireland. But all of them are not top-notch. The aforementioned article provides information on some factors to consider when choosing the best insurance brokers in Ireland.

Why There Is Security In Shredding Documents

When you have a multitude of documents that you are producing with your business, and they are stored either physically or digitally, there is the possibility that the information that is on them can be used against you. That is why, after a period of time, you should consider shredding this documentation or finding some way to permanently delete it. By doing so, you are protecting your company. This is how you can find security in shredding documents by using a company that can do all of this for you and more.

Overview Of Document Shredding Businesses

Documents that are able to shred both physical and digital documents for you are easy to find. This is big business, primarily with medium to large sized businesses, that produce thousands of documents sometimes every day. When you have sizable amounts of this, and you want to get rid of it, you can’t simply throw it in the trash. It is possible that other people are trying to obtain information on your company that they can use in unscrupulous ways. These document shredding companies will come to you, bringing their equipment with them. They will then proceed to permanently delete your digital documents and also shred your physical ones.

How Do You Find A Company That Can Do This For You?

Finding a business that can help you get this done is as simple as searching for security in shredding company. There will be multiple ones in larger metropolitan areas, and even a few companies in rural communities. Once you have located these businesses, you will want to ask them about quotes on their services. Also find out if they will come to you, or if you will have to bring everything to them. The company that you will want to choose will come to your location. This will save you the time and hassle of having to bring all of your physical documents. They will cost more, but this added convenience will make it very simple to do. Finally, they will ensure that all of your digital documents will never be recovered once they have been deleted.

How Much Do These Companies Typically Charge?

Businesses that do this will charge anywhere from a few hundred dollars to tens of thousands of dollars, depending upon the amount of documentation that needs to be eliminated. As mentioned before, if they are bringing their equipment to your location, this will certainly cost extra. For major corporations that have millions of documents that need to be disposed of, the small increase in price is not going to matter. The only thing that does matter, outside of the total cost of these services, is how efficient they are at making sure no one can recover the physical or digital data.

How Soon Can They Come Out To Your Location?

They should be able to come out to your location within the week. It depends on the size of the company, how many employees they have, and the amount of documentation that you need to have deleted. The security in shredding business that you choose should also offer a discounted price based upon how many documents need to be deleted permanently. Similar to purchasing products in bulk, you will see that you will save money by getting rid of all of your documents at the same time. The business that will be able to maintain your schedule is the one that you should choose. This means that they can come out on the date you are requesting, will shred the documents, and do so in a reasonable amount of time.

How To Know You Have Chosen The Best Company

You will know that you have chosen the best company for the job for three reasons. First of all, if you check the Better Business Bureau, or similar agency watchdog websites, you can find out if any complaints have been filed against them. Second, you will have received estimates from each business, allowing you to find out who is offering their services at the lowest price. Finally, and potentially the most important, they will have good reviews from other individuals and businesses that have used their services. If all three of these factors line up, and they are also able to come out to your location to help you, you will found the best business.

Do They Often Offer Guarantees On Their Services?

If they do offer a guarantee, it’s almost always on the digital media that they are deleting. Once the paper is shredded, it’s nearly impossible to put anything back together. However, digital documents can sometimes be recoverable. They must use state-of-the-art software that can literally shred the digital documents so that they can never be reformed. The businesses that have the best technology are the ones you will want to use, even if they are slightly higher in price. If they do offer a guarantee, then this is another reason to consider using this business.

If you can find a security in shredding company to help you, start working with them as soon as you can. As more of your documents continue to pile up, you leave yourself open to the potential of somebody stealing them. You should always have a timeframe for how long you will keep older documents, whether they are digital or physical copies. Using a company like Security Shredding is one that you can trust, a business that will save you a substantial amount of money on shredding and deleting every document that needs to be eliminated. They offer many different services including document imaging, large-format imaging, and also hard drive destruction. Document destruction, and record storage services, will also be presented. Ask each company if they provide these services and how much they will charge. Once you have decided on one of these businesses, you can feel confident that all of your most vital paperwork will be protected, and that documents that need to be removed will never come back again.

Tips To Get The Best Pembroke Business Insurances

Finding the best business insurance coverage can be a challenge. However, if you are in the market you should have some tips that will make it a little bit easier for you to find the coverage you need to have. The problem that then comes up is typically you get the advice from an insurance agent, who claims to be looking out for your best interest, but are they really looking for your best interest or theirs? Since that is the case, you may turn to the Internet and this is when you can find some tips to get the best Pembroke business insurances coverage plans you need to have. So here is a list of tips that you can use and information on what you would want to look for in the plans to find the coverage you need to have.

When dealing with other leading insurers, you should always compare quotes to get the best deals.

What Type Of Coverage Is Present

Often when you are getting the Pembroke business insurances you will notice that you are going to have a different plan than what you would usually get for your home. So you will want to make sure you know about the coverage types that are available from the company you are getting the plan from. Here are a few of the things that you are going to need to have in the plan to guarantee you get the proper coverage and have your company protected from any of the issues you may have in the future.

A form of liability coverage is going to be one of the main things that you will want to consider. While you may have not thought about this before, you need to realize that you are going to have some form of liability coverage on the products your company is selling and making. For example, if someone buys the product you made and gets injured on it, they will often sue you for the injuries. So you need to make sure you have some type of coverage in place to protect your business from this type of lawsuit.

Property coverage is something else you will need to have in a coverage plan here. When you look at your building and the stuff inside of it, you need to realize that you are going to have to get some type of protection from any damage to the building. So you need to look at getting a plan that will provide you some coverage or assistance to replace or repair any of the damaged items that are inside of the building if the building is hit by a fire, earthquake, or something else that you may have not really looked towards before.

Personal injury plans are another aspect you need to consider if you have a business that is going to have people coming into the place all the time. When you have people coming and going all the time, you may notice that you are going to have some issues with people that trip or fall in your business and get hurt. When they do they tend to want compensation for the pain and suffering so you will want to consider the different coverage plans that offer this insurance.

What Coverage Limits Are Available For The Coverage

Looking at the Pembroke business insurances you will notice that some of them will have a variety of different coverage limits in place. Since this is the case, you will want to look at the limit that is present in the plan and know more about the coverage that is available. This way you will be aware of the amount the plan will pay out and what the maximum amount the plan will pay out before it is going to end up getting some issues with the coverage plans not getting the coverage you need to have for injuries that people are going to have.

How Easy Is It To File A Claim With The Insurance

While you hope you never have to do this, you need to realize that you are going to need to know about how easy it will be for you to file the claim with the company. If the process is complicated and very difficult then you may find that getting the company to pay out the amount of money they are supposed to be paying out is going to be a long and complicated process as well. However, if the process is fairly easy, then you could most likely expect to get the same type of results when you are waiting on the company to pay out to the person who has filed the claim.

Cost Of The Insurance Coverage For The Business

This is the scary part about any type of insurance and that is the fact that you are going to have coverage and it does cost some money. Since it can vary greatly in the cost you will want to consider the different cost associated with the coverage plans you are going to be using. For example, if you are using the coverage very sparingly and have only the minimum amount of coverage then the amount you have to pay is going to be quite a bit less than what you expect. However, if the plan is one of the top of the line types of plans, then you could end up paying quite a bit more for the coverage than what you were expecting on your business budget.

Running a business is a great way to be your own boss, but it does come with a lot of responsibility as well. This is when you need to know some tips to help you get the best deal and find the right coverage on your Pembroke business insurances you need to have. By using these tips it will be very easy for you to find the best coverage and know you are going to be able to afford your coverage and at the same time keep your company competitive with what you are selling.

Get Quote Devil Car Insurance

Insurance is an essential part of life, and it is necessary to protect you in the case of an emergency or another event that you did not plan. It is one of those things that to be without it would be making a profoundly unwise choice not only for you but possibly for anyone involved. There are many kinds of coverages to protect individuals living in Ireland, and one of them is car insurance, such as the coverage offered by QuoteDevil.ie/car-insurance. This is a fully bonded and insured company. So it is not one of the fly-by-night organisations that pop up to scam unsuspecting persons. It was launched in 2009, and the team has over 40 years of experience in the Insurance Market. Working with an organisation that has experience is especially important when it comes to premiums. The goal of the company is to not only provide a quality product but to do it at low rates and in the fastest possible time. When a company makes such a claim, it is essential for them to stand behind what they say. Before we get into the details of what is offered, let’s explain why you need such a plan for yourself and for your car.

Why do you need coverage for your car?

There are many reasons as to why you need such protection for yourself and for your car. One of the most important is that driving without insurance in Ireland is illegal. If you are caught, it can be punishable by a hefty fine and even imprisonment. The reason there are stiff penalties for being an uninsured driver is to protect not only those who are on the road with you but to protect yourself. Taking a chance on being uninsured to save money is never wise.

Second, motor policies give you financial protection in the event that your vehicle is damaged in an accident. This protection not only covers your car, but it includes any injuries to you, other passengers, other drivers, any pedestrians, and the property of others. Without such insurance, the costs to cover these factors could be astronomical. The charges could be so bad that you could be severely financially hardened or even bankrupt. Vehicle insurance also covers you if your car is stolen, destroyed by fire or vandalised. Policies like these make it a goal to cover as much as possible.

Why Quote Devil car insurance?

1. They have some of the cheapest rates in Ireland

Automobiles, in and of themselves, are expensive. Even if you were to buy a used car, you are likely putting out a large sum of money. With the addition of vehicle coverage, something that is mandatory in Ireland or faces stiff penalties, the price of owning a vehicle becomes even more expensive. Quote Devil has some of the cheapest rates on comprehensive coverage and is dedicated to getting you the lowest price possible. Therefore, you save money that can be applied to other bills. They have a team of dedicated advisers, based in Dublin, who can access your situation, compare various policies and rates, and come up with a plan for you. Furthermore, the company can offer installments which are especially helpful to people who are on a budget or who are acquiring their first policy.

2. Getting started is user-friendly

You can either call the company or you can fill out the online form and get a quote. Everything is designed for you to get signed up in a user-friendly way. These days cheap insurance doesn’t automatically mean it is inadequate. You can get good coverage fast and you can do it without worry or hassle.

3. The vehicle insurer offers extras

If you were to research vehicle insurers, you would see that not all offer the same thing. Quote Devil car insurance offers a variety of extras such as benefits for female drivers, breakdown assistance, coverage if you drive someone else’s car, windshield cover, etc. These are factors that every person looking for this kind of information should take into consideration.

Looking at the coverage for women drivers, for example, the company ensures that they look at the most appropriate coverage regardless of gender. Therefore, they look at the most suitable policy. This is not a cookie-cutter coverage, but one that is tailored for each customer. If you are a single female, for example, this kind of attention can ensure that you get the kind of protection that is ideal for you.

4. They offer a multi-policy discount

Are you familiar with the term multi-policy discount? It refers to bundling more than one insurance policy together. For example, you can bundle vehicle coverage with home coverage. Doing so can save you money. In addition, because your plans are kept in one place, it makes it that much easier for you. Quote Devil not only has vehicle insurance but they also offer home, life, pet, travel, business, and more. Essentially, you can get all the plans you need with the company, which saves you time and should save you money as well.

5. They offer no claims discount

If you are a good driver, many companies will reward that kind of record. You could save up to 60 percent on your premium if you are a good driver. Your no claims bonus can also be protected in the event of a claim. Rewarding good drivers is another way to ensure that Ireland’s roads are as safe as they can be.

6. They offer vehicle alarm discount

Does your vehicle have an alarm or an immobiliser? You can get a discount of up to 10 percent. You can get rewarded for doing what you can to ward off theft.

7. They offer a courtesy vehicle

If your car has been stolen or is being repaired, the company offers a courtesy vehicle with fully comprehensive policies. Therefore, there is no need to worry about being without a car. The company has locations throughout Ireland, making getting a courtesy vehicle hassle free. This is one of the best reasons to go with a company that offers extras or perks.

8. Declined drivers are encouraged to check it out

Not everyone is accident-free. Some drivers have accidents on their records, and therefore, it’s hard for them to get insured. It’s as if their past is a complete detriment to trying to improve and get ahead. Quote Devil has specialists that are trained to provide the attention declined drivers need. They know what to do if you have had a conviction if you have lost you’re no claim bonus, or if you have an outstanding claim. With that being said, premiums for this kind of coverage are typically higher but is a start for cleaning up your record and building toward a no claims bonus.

Having an accident on your record is not the only reason people get declined. You may be denied if your vehicle is over 15 years old. The vehicle policy coverage company has specialists who can look at cases where people seeking insurance are rejected due to the age of their cars. This is something that has been happening more and more and has become a real problem for people seeking these kinds of plans.

You can get a quote in less than one minute from Quote Devil car insurance. The products are sold online only which eliminates the kind of expenses that other companies deal with. You can not only get great rates but you can get the extras that make life easier.

Benefits Of Buying Insurance From Quote Devil Insurance

There is a lot more to buying an insurance policy than asking for a quote from an insurance company and signing on the dotted line. One of the most common misconceptions associated with the insurance industry is that consumers can save a lot of money by buying insurance directly from the insurance company but anecdotal evidence suggests that there are several benefits of buying insurance through an experienced and reputed insurance broker such as Quote Devil Insurance. Here is a list of some of the major benefits of using an insurance broker for all your insurance needs.

There is a lot more to buying an insurance policy than asking for a quote from an insurance company and signing on the dotted line. One of the most common misconceptions associated with the insurance industry is that consumers can save a lot of money by buying insurance directly from the insurance company but anecdotal evidence suggests that there are several benefits of buying insurance through an experienced and reputed insurance broker such as Quote Devil Insurance. Here is a list of some of the major benefits of using an insurance broker for all your insurance needs.Expertise

Cost

Personalised Service

Ease of Buying Insurance

Another common misconception associated with direct buying of insurance from an insurance provider is that it’s extremely easy as compared to going through an insurance broker such as Quote Devil Insurance. Nothing could be further from the truth.

Another common misconception associated with direct buying of insurance from an insurance provider is that it’s extremely easy as compared to going through an insurance broker such as Quote Devil Insurance. Nothing could be further from the truth.Regulated

Conclusion

5 Practices That All Great Billing Companies Use

When you’re in need of billing and payment management services, you want to ensure that you’re putting your trust in the right hands. There are lots of billing companies out there, but not all of them are reputable. When choosing the billing company that best suits your business, there are some things that you need to make sure to come with the company you choose.

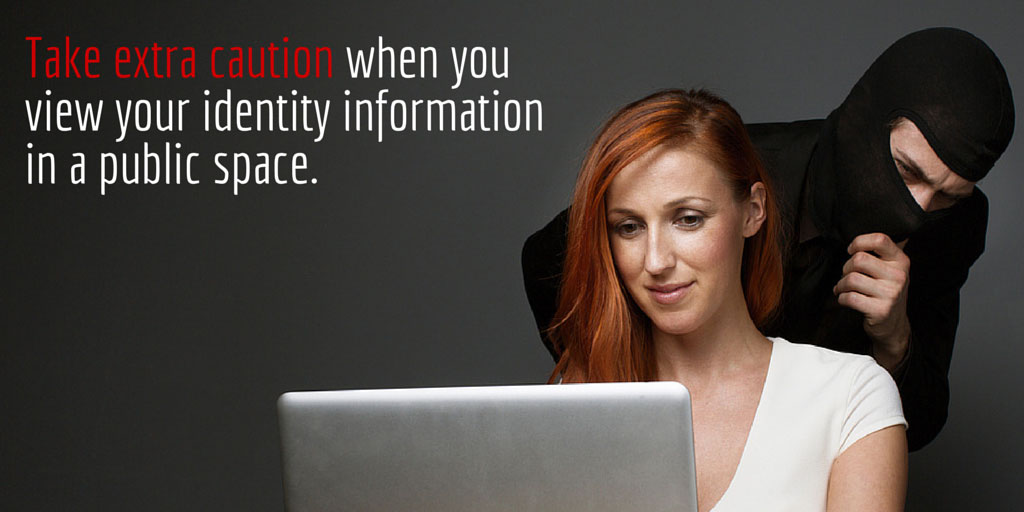

They Secure Your Data

Private information of yours or your clients’ is always vulnerable to possible viral attacks and hacking schemes. Not only should you know that the company protects this sensitive data, but you should also inquire as to how exactly they go about doing so. How do they protect the information of the people whose details they have access to for the purposes of billing?

They Deliver Detailed Reports

At the end of every month, your billing company should release to you a document detailing the most useful information as it pertains to your company and the billing process. Over time, this data can help business owners to identify patterns that they can then use to set realistic expectations of their business.

Some billing companies grant you the ability to run and access your own reports, which is definitely a feature that you should consider making a priority.

Their Technology is Up-to-Date

Having outdated technology leaves information processors running more slowly and makes them more vulnerable to the kind of catastrophe that exposes private information to unwanted parties. If their services are often upgraded and their technology is as well, you can bet that you’re dealing with a billing company that takes their responsibilities seriously. Each industry has its challenges, and your billing company could help you to conquer some of them if they have the right technology, attitude and sense of innovation.

They Never Leave You in the Dark

When your billing company rolls out a new service, application, software program or upgrade of some kind, you should know about it. Not only should you be made aware of these changes, but you should also be given at least a bare-minimum insight into how to operate whatever new features your billing company releases.

They Readily Give You Access to Your Own Data

Never trust a billing company that doesn’t allow you to access your own company’s data. You need to be able to run reports in order to assess numerous aspects of your business, and you shouldn’t have to wait for someone to deliver them to you via email in order to get that important information. This type of system is also used by many house and home insurance companies.

Not having this kind of access is especially problematic if you ever choose to switch over to another billing service. Not being able to obtain your old records can make the transition to a new service more difficult and frustrating.

How a Billing Company is a Valuable Asset for Your Business

Meticulous record-keeping is essential to keeping your business on the right track. Many ambitious entrepreneurs that open up a business want to take on this role themselves, either because they feel that it best keeps them informed of their business operations or because they are reluctant to pay for the services of a billing company. This article will inform you of just how valuable a billing company can be for a business of any size. See how Quote Devil insurance brokers have thrived by using effective billing solutions!

Top 3 Reasons to Enlist a Billing Company’s Services

There are many reasons that may drive you to hiring a billing and payment processing company. Without knowing your unique set of circumstances, here are the top three reasons we find that business owners recruit the help of a reputable billing company.

You Save Time

When you’re in charge of running a business, your time is of the utmost value. Business owners who try and take on the added responsibilities of billing and payment processing often find themselves over-burdened by the sheer number of tasks they must perform on a daily basis. When your time is spent in your office processing invoices and ensuring payments, that means that you’re spending less time performing the service that your business provides.

With the help of a billing company, you free up this portion of your time to focus on the operations of your business.

You Have Access to All the Data

Any billing company worth its salt grants their clients access to their business’ information. You should be able to run reports for assessment purposes and regularly check in to see if patterns are forming in the data itself. As the business owner, you get the advantages of having your secured data managed by another company while still having the freedom to access this information whenever you need it.

Everything Stays Organized for You

It’s a challenge to keep on top of the sea of transaction paperwork that is a part of a business’ operation. Invoices from vendors, billing statements sent to clients, payment processing documents and more can quickly pile up into a seemingly insurmountable mess of numbers that still need to be processed. A billing company not only handles these matters for you, but their specialists also ensure that the data they handle is well-organized so that it may be accessed later.

Forget about stashing invoice receipts into a file cabinet to sort through later. When you hire the help of a billing company, you simply don’t have to worry about these documents until you need to pull them up later. And when you do, they’re available at your fingertips.

Contact Us

Ambitious business owners often try to take on as many roles as they can, out of obligation or in order to save a few dollars. This is admirable, but it takes them away from the day-to-day operations that keep their business afloat. A&E Billing is a valuable service to add to your professional team. We’ll handle all of your payment and billing processing needs so that you can focus on running your business. Contact us today to see how A&E Billing can fit into your life today.

Our Location

A & E Billing Solutions

1839 Denver Avenue,

Perris, California,

USA 92370

Phone: 951-443-0962

Email : info@aebillingsolutions.com